Understanding the Current Trends in ASTS Stock Price

Introduction to ASTS Stock Price

ASTS Stock Price, or AST SpaceMobile Inc., is a company that operates at the intersection of telecommunications and satellite technology, aiming to create a unique global cellular network solution via satellite. The ASTS stock price serves as a financial representation of the company’s market value and is an important indicator for investors contemplating the viability and growth potential of AST SpaceMobile’s innovative business model. With a focus on providing reliable cellular connectivity directly through satellites, the company addresses the persistent challenge of connectivity in remote areas, making it a key player within the burgeoning aerospace and telecommunications sectors.

The significance of ASTS stock in the market can be attributed to the growing demand for mobile broadband services globally, particularly in underserved regions. As the world becomes increasingly interconnected, the need for robust and dependable communication solutions has never been more evident. AST SpaceMobile’s objective is not only to provide Internet access but to ensure that quality cellular service reaches those areas traditionally overlooked by conventional network providers. Thus, investors are closely monitoring the fluctuations in the ASTS stock price, as these movements may reflect broader market trends and technological advancements within the industry.

Moreover, understanding the market dynamics surrounding the ASTS stock price requires an exploration of various factors, including technological compatibility, regulatory environments, and competition within the satellite communication landscape. Investors and analysts often pay attention to press releases, quarterly earnings, and technological milestones achieved by AST SpaceMobile, as these announcements can significantly influence the stock’s market performance. As we delve further into the trends related to ASTS, it is important to grasp how the company’s operational strategies and innovations may impact its stock price trajectory moving forward.

Historical Performance of ASTS Stock Price

The historical performance of ASTS stock price offers valuable insights into the company’s trajectory since its inception, allowing investors to assess past trends and make informed predictions about future movements. Initially launched in the public market, ASTS experienced significant volatility characterized by distinct peaks and troughs, which can be attributed to various internal and external market factors.

During its early days, ASTS stock price saw a notable surge, largely fueled by optimism regarding its innovative technology and potential market applications. This initial rally attracted a wave of investors, driving the stock to its all-time high. However, as excitement waned and market speculations settled, the price experienced corrections, reflecting broader market conditions and sector-specific challenges. Events such as regulatory changes and competitive entries played a critical role in impacting investor sentiment during these periods.

Additionally, significant global events, including economic downturns and technological breakthroughs, have historically influenced the fluctuations in ASTS stock price. For instance, periods of economic uncertainty often led to increased volatility, as investors reassessed their positions amid changing market dynamics. Conversely, announcements of strategic partnerships or advancements in technology often prompted positive reactions in stock performance, illustrating how external factors can dramatically reshape trader perceptions.

Furthermore, analyzing past performance data provides crucial context for current trends. By examining the highs and lows of ASTS stock price, market analysts can identify patterns that may suggest future behavior. Investors frequently seek to understand how historical events relate to present circumstances, thereby informing their strategies. As the market continues to evolve, it will be imperative for stakeholders to stay abreast of these trends, drawing lessons from the past to navigate future opportunities and challenges effectively.

Factors Influencing ASTS Stock Price

Several internal and external factors play a crucial role in determining the ASTS stock price. Understanding these elements can provide investors with insight into potential price movements and market behavior. One primary driver of any stock price is the company’s financial performance. For AST SpaceMobile, consistent revenue growth, profitability levels, and overall financial health contribute to investor confidence and demand for shares, directly impacting the stock price.

Innovation is another significant factor influencing the ASTS stock price. As a technology-based company focused on satellite communications, advancements in its services and product offerings can attract interest from investors. Successful launches, technological breakthroughs, or strategic partnerships can lead to increased expectations for future growth, thus positively affecting the stock price. Conversely, any delays or failures in innovation may adversely affect investor sentiment.

Market competition can also influence the positioning of the ASTS stock price. With the telecommunications industry evolving rapidly, the presence of strong competitors can pressure the company’s market share and pricing strategies. The ability to maintain a competitive edge through unique offerings or superior services will ultimately reflect in the stock’s performance on the market.

Furthermore, global economic conditions greatly impact investor sentiment. Macroeconomic indicators such as inflation rates, interest rates, and overall market stability can sway investor confidence. In economic downturns, even a fundamentally strong company may experience declining stock prices as investors pull back on their risk appetite. Therefore, attentive monitoring of these economic factors is essential for understanding fluctuations in the ASTS stock price.

Lastly, investor sentiment can often be influenced by trends in media coverage and market speculation. Positive news can trigger buying, while negative reports can lead to sell-offs, directly impacting the ASTS stock price in the short term. Overall, while many factors can exert influence, the interplay between these elements ultimately determines the stock price trajectory.

Recent Trends and Current Analysis of ASTS Stock Price

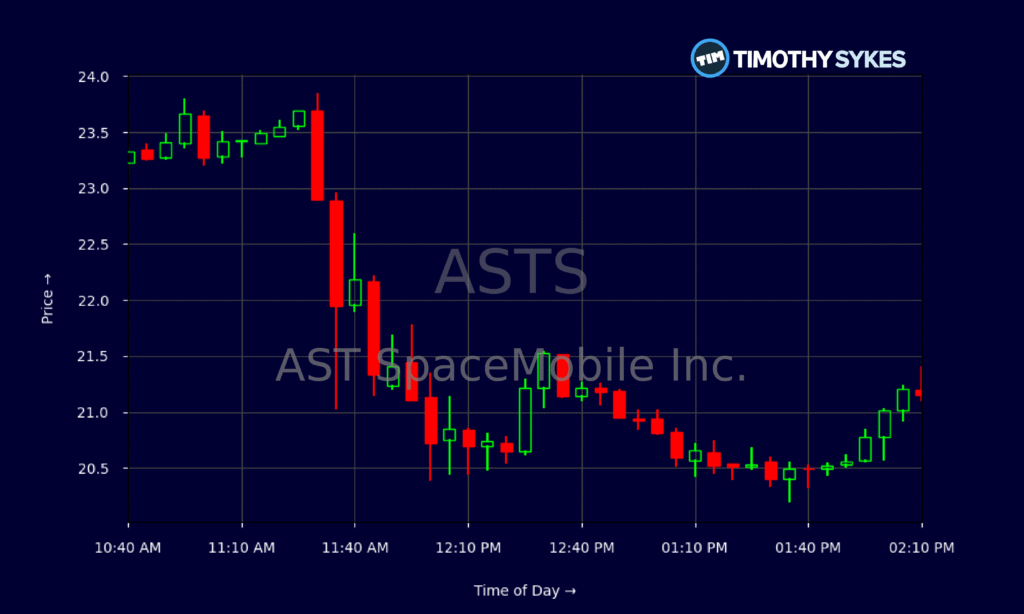

The ASTS stock price has undergone considerable fluctuations in recent weeks, reflecting a volatile market environment. As of October 2023, the stock exhibited a notable uptick in value, leading analysts to scrutinize various factors influencing these changes. The increased interest in ASTS shares can be attributed to broader market trends, investor sentiment, and company-specific developments. Investors have observed that the stock price experienced a pivotal rally during the past month, with significant gains recorded over several trading days.

Technical analysis of the ASTS stock price reveals some critical patterns. The stock successfully breached its resistance levels of $5, demonstrating bullish momentum. Additionally, the relative strength index (RSI) indicates that the stock is nearing overbought territory, warning of potential price corrections ahead. This signal is particularly critical for long-term investors to consider their positions in light of prevailing market conditions.

In line with this, significant movements in the ASTS stock price have been influenced by a series of announcements from the company, including new partnerships and advancements in technology, contributing to heightened investor confidence. The latest data also indicates increased trading volume, suggesting that there might be a shifting sentiment among traders and investors. Such dynamics could indicate that the current ASTS stock price trajectory may either sustain its upward momentum or face retraction depending on upcoming market trends and fundamental performance.

Overall, the analysis indicates that while recent trends have been favorable for ASTS stock, continued monitoring of market conditions and company developments remains essential for a well-informed investment approach. Investors are advised to stay updated on upcoming earnings releases and any shifts in macroeconomic indicators that could impact ASTS’s stock price moving forward.

Comparative Analysis with Industry Peers

Evaluating the ASTS stock price against its competition within the satellite and telecommunications industry provides important insights for investors seeking to understand the company’s market position. In recent months, AST SpaceMobile has faced numerous challenges characteristic of the evolving market landscape. However, the overall performance of ASTS stock in comparison to its peers reveals distinct trends that merit discussion.

When analyzing the ASTS stock price, it is essential to consider growth metrics such as revenue, earnings per share (EPS), and market capitalization relative to competitors. For instance, companies like Globalstar and Iridium Communications are often referenced benchmarks for performance comparisons. In the latest fiscal quarter, while AST SpaceMobile reported a growth rate of approximately 12%, Globalstar and Iridium displayed growth rates of 8% and 10%, respectively. These figures suggest that ASTS is outpacing some of its direct competitors in terms of growth, which may reflect positively on investor sentiment.

Market capitalization is another critical aspect to consider. As of the last assessment, AST SpaceMobile holds a market cap of around $1.7 billion, placing it competitively within the sector. In contrast, Globalstar and Iridium exhibit market caps of $2 billion and $1.5 billion, respectively. This positioning indicates that AST has carved out a solid niche that, despite being lower than Globalstar, still demonstrates viability in a competitive space.

Furthermore, trends in the ASTS stock price show some volatility, reflecting broader market uncertainties; however, the long-term prospects remain promising based on advancements in technology and the company’s strategic partnerships. By analyzing the stock price variability alongside its peers, investors can make informed decisions about the attractiveness of investing in AST SpaceMobile. These comparisons emphasize the necessity of continual monitoring for stakeholders interested in capitalizing on growth opportunities within this dynamic sector.

Investor Sentiment and Market Reactions

The sentiment regarding ASTS stock price has shown significant variability in recent months, influenced by a range of factors that permeate social media discussions, analyst ratings, and broader news coverage. Investor sentiment often serves as a barometer for understanding market dynamics, and in the case of ASTS, it reveals a growing interest among retail investors particularly keen on technological advancements and space-related initiatives. Social media forums, such as Twitter and Reddit, have seen extensive discourse on ASTS, highlighting key updates, speculative discussions, and projections that shape public perception and, ultimately, the stock’s market performance.

Additionally, analyst ratings have played a critical role in shaping investor attitudes toward ASTS stock price. Analysts’ predictions, particularly when they align with positive news on technological developments or partnerships, can lead to bullish behavior among investors. Conversely, any negative outlook can dampen enthusiasm, leading to declines in stock valuation. Recent analyses underscore a disparity in opinions, with some experts projecting robust growth due to technological innovations, while others remain cautious, pointing to market saturation and competition as significant challenges.

The overarching media coverage also contributes to investor sentiment. Positive features about ASTS’s growth potential, paired with coverage of industry trends that favor the company’s business model, can bolster confidence among investors. Conversely, unfavorable reports regarding regulatory challenges or strategic missteps may evoke hesitance. Understanding this duality is crucial for investors as they navigate decision-making. Through keen analysis of social media chatter, expert ratings, and prevailing news discourse surrounding ASTS stock price, investors are better equipped to assess potential risks and rewards associated with their investments in this evolving market environment.

Future Projections for ASTS Stock Price

As investors assess the future of ASTS stock price, they must consider various factors that may influence its trajectory in the foreseeable term. Market analysts generally express cautious optimism, primarily due to increasing demand for innovative satellite communication services, which align with ASTS’s core business model. The proliferation of 5G technology and the envisaged growth of Internet-of-Things (IoT) applications are anticipated to enhance the revenue potential for companies in this sector, including ASTS.

Moreover, the ongoing expansion of ASTS into new global markets could significantly impact its stock price. By penetrating underserved regions, ASTS aims to capture new customer bases, which could drive revenue appreciation. However, potential geopolitical tensions and regulatory challenges remain a concern, as they could hinder the company’s expansion plans. Analysts will continue to monitor these elements closely, as any adverse regulations or trade barriers could negatively affect the stock price.

Industry experts are keeping a watchful eye on technological advancements that ASTS might adopt in the coming years. Enhancements in satellite technology, including better bandwidth and reduced latency, could bolster the company’s competitive edge. If ASTS successfully integrates these technologies, it could position itself favorably against its counterparts, thereby improving investor sentiment and potentially elevating the stock price.

Overall market conditions are also crucial. Economic fluctuations and consumer behavior, particularly in sectors that rely on satellite communications, could either bolster or dampen the expected growth trajectory of ASTS’s stock. As the market begins to stabilize post-pandemic, the alignment of ASTS with emerging trends may contribute positively to its stock price. Investors should keep abreast of these dynamics as they unfold, leveraging both expert opinions and industry trends to make informed decisions about ASTS stock.

Risks and Considerations in Investing in ASTS Stock

Investing in any stock carries inherent risks, and the ASTS stock price is no exception. One of the primary concerns for potential investors is volatility. The prices of stocks can fluctuate significantly in short periods, and ASTS has experienced notable price swings. Such volatility can be influenced by market sentiment, news about the company, or broader economic indicators, potentially leading to substantial financial losses. Thus, it is essential for investors to assess their risk tolerance before considering ASTS stock.

Market speculation is another critical factor to consider when analyzing the ASTS stock price. Stocks that gain attention often receive fluctuating investment based on speculative trading, rather than their actual performance. Investors may find themselves caught in cycles of bullish and bearish sentiment, which can distort the true value of the stock. It is vital for potential investors to conduct thorough research and not solely rely on trends driven by market speculation.

Financial instability is another significant risk for those considering ASTS. Any company undergoing economic challenges may face declining revenues, which can directly impact its stock price. Investors should stay vigilant for financial reports and indicators of the company’s health, such as profit margins, debt levels, and cash flow. Such insights can provide a clearer picture of the potential risks associated with investing in ASTS.

Additionally, external factors such as regulatory changes or shifts in industry standards can also affect the stock’s performance. These unpredictable elements can introduce unforeseen risks, further complicating investment strategies. Therefore, being aware of these risks and having a clear investment strategy are paramount for anyone thinking about adding ASTS to their portfolio.

Conclusion and Final Thoughts on ASTS Stock Price

In examining the current trends surrounding the ASTS stock price, it becomes apparent that understanding this financial metric is crucial for both potential and existing investors. Recent fluctuations in ASTS stock price underscore the broader dynamics at play within the telecommunications and aerospace sectors, particularly as AST SpaceMobile positions itself to transform mobile communications by leveraging satellite technology. This innovative approach presents a unique value proposition, influencing investor sentiment and stock performance.

Throughout the analysis, we have observed that various factors—ranging from technological advancements, strategic partnerships, to market competition—play significant roles in shaping the trajectory of the ASTS stock price. By remaining attuned to these influences, investors can make informed decisions, adapting to changes in the market landscape that directly impact AST SpaceMobile’s financial health. Furthermore, the growing interest in satellite internet services as a viable solution for global connectivity suggests a long-term growth outlook for ASTS stock.

Investors should prioritize staying informed about ongoing developments related to AST SpaceMobile. Keeping a close eye on company announcements, industry trends, and financial reports will provide essential insights that contribute to a deeper understanding of the reasons behind movements in the ASTS stock price. The telecommunications market is evolving rapidly, and AST SpaceMobile’s unique positioning may yield significant returns for investors who act wisely based on comprehensive market analysis.

Ultimately, understanding the ASTS stock price within the broader context of technological innovation and competition will equip investors with the knowledge necessary to navigate their financial journeys. Engaging with this information not only fosters better investment decisions but also encourages confidence in the potential of AST SpaceMobile to redefine connectivity in the years to come.

You May Also Read This IcryptoAi.